California cars and truck insurance policy prices Average annual minimum insurance coverage costs Typical annual full insurance coverage premium $733 $2,065 California automobile insurance coverage prices by city, Automobile insurance coverage prices in California differ by city - trucks. Drivers in densely populated areas often tend to have higher prices. Having even more lorries when driving might indicate a higher chance of a mishap.

cheap vehicle insurance insurance affordable car

cheap vehicle insurance insurance affordable car

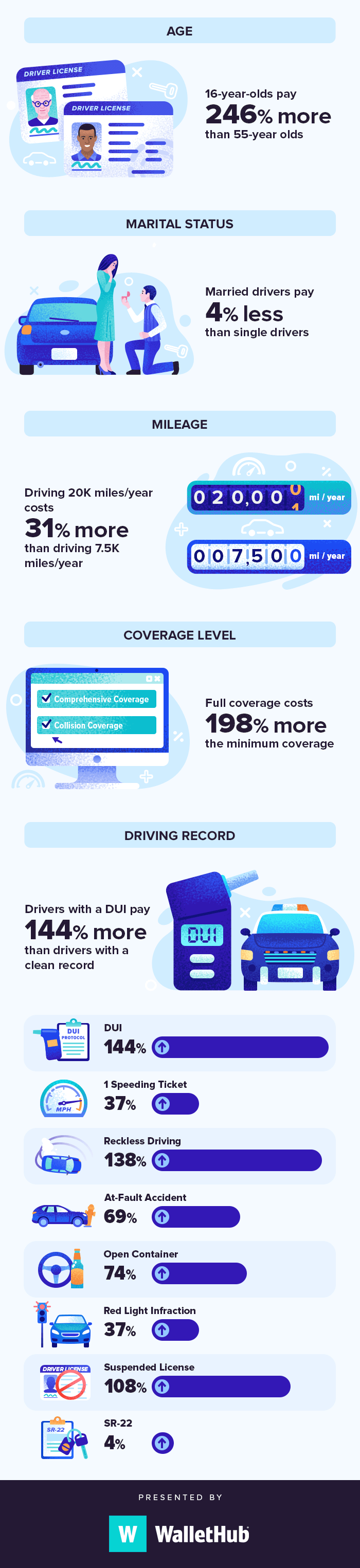

Utilize this chart as a guide to help identify your overall costs so that you can determine what insurance prices fit in your budget. California automobile insurance coverage rates by age, A chauffeur's age typically adds to the cost of yearly premiums, as it can show how statistically dangerous a vehicle driver is - cheap car insurance.

California car insurance policy prices by credit report score, In lots of states, your credit-based insurance policy score will influence just how much you pay for automobile insurance. This is since chauffeurs with low credit scores statistically often tend to submit even more claims than vehicle drivers with higher credit scores, according to the Insurance policy Info Institute (Triple-I).

Regularly asked questions, Just how much is vehicle insurance in California monthly? Complete protection auto insurance sets you back approximately $172 monthly as well as minimum insurance coverage sets you back $49 per month, on standard, in California. Your rates might be higher or reduced depending upon your specific score aspects, according to the Triple-I. What is the ordinary expense of minimum insurance coverage in California? Minimum coverage sets you back a standard of $733 each year in the Golden State.

However, the Triple-I suggests you consider buying protection degrees above the state minimums for fuller economic security (risks). It is crucial to note that the state's minimum insurance coverage does not include any coverage for your vehicle if you are at mistake in a crash (cheapest car). If you have a leased or financed vehicle, you will likely require to bring complete coverage, that includes extensive and also collision.

What Does Blue Cross Blue Shield Mean?

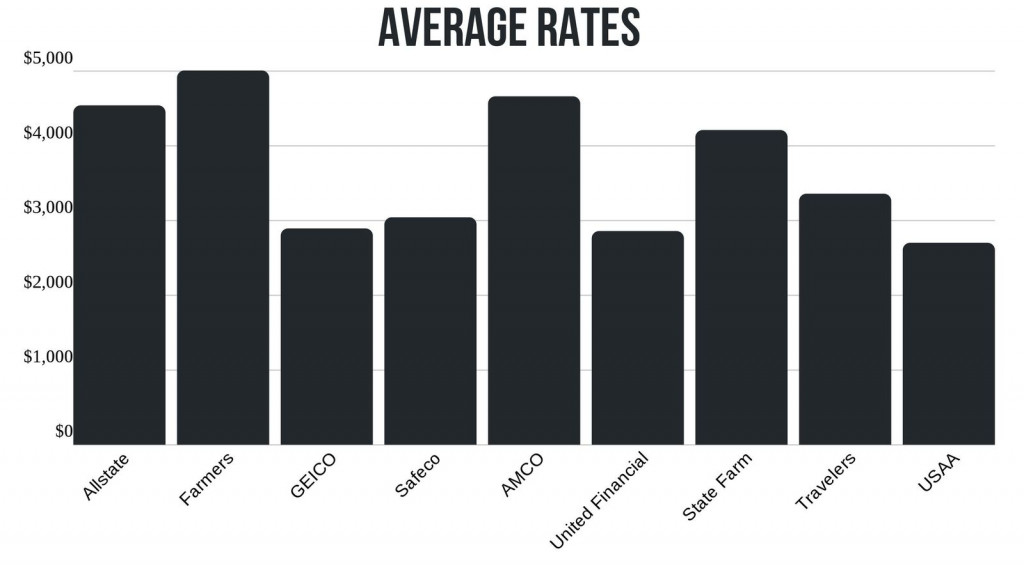

What is the best automobile insurance policy firm in California? Based on our research, Geico, Progressive, State Ranch as well as Wawanesa are amongst the best automobile insurance policy firms in California.

affordable auto insurance insurance affordable cars cheap insurance

affordable auto insurance insurance affordable cars cheap insurance

Prices were determined by reviewing our base profile with the ages 18-60 (base: 40 years) applied. For teenagers, rates were determined by including a 16- or 17-year-old teenager to a 40-year-old married couple's plan.

.jpeg) car insured credit score vehicle insurance low cost auto

car insured credit score vehicle insurance low cost auto

Prices were determined by reviewing our base profile with the following events used: clean record (base), at-fault accident, solitary speeding ticket, single DUI sentence as well as lapse in protection. insurers.

We damage down the nine most crucial points that affect your vehicle insurance coverage prices. When considering your vehicle insurance prices, the degree of insurance policy you select is one of the most essential aspects to just how much you'll pay.

03 Met, Life $223. 15 Bristol West $277 - cars. 27 $178 (insurance). 48 Source: Savvy Keep in mind that there are state demands that might figure out the types of insurance coverage you're required to have. Vehicle insurance rates are also affected by your choice to select a high-deductible plan or a low-deductible plan.

The Only Guide for Car Insurance Guide For California Teens - Driversed.com

Teenager drivers pay the highest possible vehicle insurance rates. The effect of age is considerable, with teenager drivers paying at the very least $400 more typically than other age (cheaper auto insurance). The most affordable typical insurance rates are for drivers in between 25 as well as 34 as well as rates begin to enhance once again for older motorists over age 50.

While a normal credit rating predicts the likelihood that you'll pay your expenses in a timely manner, a credit-based insurance coverage rating predicts the likelihood that you'll submit an insurance case of a higher amount than what you'll pay in insurance coverage costs - low-cost auto insurance. Some states have relocated to restrict or protect against car insurance firms from using credit report to figure out insurance policy rates (vehicle insurance).

trucks accident insurance companies risks

trucks accident insurance companies risks

In one scenario, an 18% boost in retail price led to a 6% boost in auto insurance premium rates. Insurance policy might likewise be higher on automobiles that are usually the target of criminal offense (credit score). Discover out just how much your vehicle is worth to discover just how your insurer consider the automobile you drive.

You can attempt various other techniques such as telematics, which enables an insurance firm to track your driving routines as well as if they're great, you'll make a discount - insurance.

business insurance prices money cheaper car insurance

business insurance prices money cheaper car insurance

Q What is the Moratorium For California's Vehicle Insurance policy? A In The golden state, If you require new vehicle insurance coverage then you will certainly obtain an one month moratorium. If you currently have among your existing or previous vehicles and also you wish to transfer it then you will obtain 45 days of the poise duration. vehicle insurance.

What Does Olive® Extended Car Warranty Solutions - Pays Your Auto ... Mean?

Q Exactly How Much Does Vehicle Insurance Policy Price In Leading get more info California Cities? A California state has reduced insurance policy prices as contrasted to other states in the USA. And every city determines the cost based on various aspects (auto insurance). Because of this; We have actually analyzed determined the typical auto insurance coverage cost in the top The golden state Cities: $155 monthly $141 each month $133 per Month $85 each month $120 per Month $114 monthly $151 each month.

To get begun, buy a policy in as little as one min - cheap car., you can purchase a plan in the Tesla app before taking delivery as well as once you have actually an appointed VIN in your Tesla Account.

You will make monthly repayments based upon your driving actions rather than typical factors like debt, age, sex, insurance claim history and also driving records made use of by other insurance coverage carriers. Your costs is determined based on what car you drive, your offered address, how much you drive, what protection you pick and the automobile's month-to-month Security Rating. auto.