If you have a history of having vehicle insurance plans without filing insurance claims, you'll obtain less costly prices than somebody who has actually filed insurance claims in the past.: Autos that are driven much less regularly are less likely to be involved in an accident or other damaging occasion. Automobiles with reduced yearly gas mileage may get approved for a little lower rates - cheap car.

car insurance insure cheapest car insurance affordable

car insurance insure cheapest car insurance affordable

To locate the very best vehicle insurance policy for you, you must comparison store online or speak to an insurance policy representative or broker. cheap car. You can, yet make certain to keep track of the protections chosen by you and also offered by insurance providers to make a fair contrast - car insured. Alternatively, you can who can aid you find the ideal mix of cost and also fit.

Independent representatives help multiple insurance provider and also can contrast among them, while captive representatives function for just one insurance policy business. Provided the different ranking methodologies and also variables utilized by insurance companies, no single insurance coverage company will certainly be best for everyone (prices). To much better understand your regular car insurance policy price, invest time comparing quotes across companies with your chosen approach.

Prices were calculated by examining our 2021 base account with the ages 18-60 (base: 40 years) used. Prices for 18-year-old are based on a vehicle driver of this age that is an occupant (not a home owner) and on their very own policy.

The smart Trick of How Much Should I Be Paying For Car Insurance? - Car And ... That Nobody is Discussing

Washington State currently permits credit report as a score element, however a ban on its use is currently on hold in the courts (cheap auto View website insurance).

Picking the best cars and truck insurance policy protection, Obtaining the appropriate level of automobile insurance coverage is not one dimension fits all. What is most essential to one cars and truck proprietor isn't necessary for one more - cheaper car. That's why it's essential to get a bird's eye sight of the different kinds of auto insurance coverage as well as the vehicle insurance coverage that fits your specific's Car Insurance coverage Calculator is a quick way to locate the right car insurance coverage degrees and also alternatives for you.

And also do not stress if you want to understand what the most inexpensive rates and best protection coverages would certainly be, we let you toggle in between the outcomes for both. How much automobile insurance coverage do I require? It will certainly also pay for damages you triggered to a person else's residential property, for instance if your amateur teenager chauffeur strikes your neighbor's fence.

Some Known Incorrect Statements About Average Cost Of Car Insurance - Nextadvisor With Time

Comprehensive covers your automobile for "various other than collision" events like burglary, fire and damages from weather occasions like flooding as well as hailstorm - cheap. Accident covers, despite fault, if your cars and truck is damaged in an auto crash or if you roll or turn your cars and truck by crash. Compensation as well as accident are not called for by any kind of state however is financing companies if your automobile has a lease or lending on it.

auto insurance cheaper car vehicle cheaper car

auto insurance cheaper car vehicle cheaper car

cheaper car insurance affordable car insurance insurance companies cheap

cheaper car insurance affordable car insurance insurance companies cheap

It covers the "void" left when your insurance payout is not sufficient to cover the benefit on your auto. Paying for this additional coverage is far better than continuing paying on an automobile that you no more cars and truck drive (insured car). If you enroll in space insurance policy, your insurer will determine just how underwater you are with your vehicle worth as well as determine just how much the policy would certainly pay out.

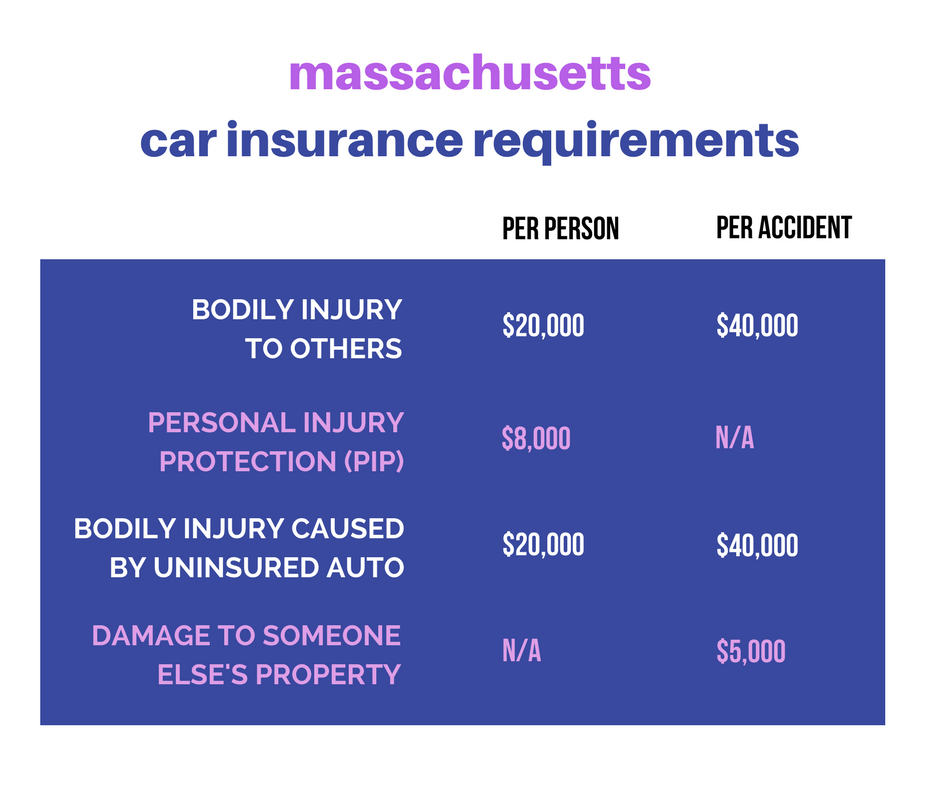

You place your injury claims through your very own insurer initially in no-fault states. Just how much PIP you must carry will be dictated by state mandates.Uninsured/ Underinsured vehicle driver is required in some states as a means to cover injuries you receive in a vehicle crash if the at-fault celebration was uninsured or underinsured. If you have a great deal of assets you can shed in a judgement, an umbrella plan is a means to shield them. It is optional coverage and also just how much you need depends on your possessions and monetary circumstance. As you undergo the automobile insurance policy calculator you will figure out the suggested automobile insurance policy coverages based on your responses. Insurance policy business ranking systems differ so depending what protections, restrictions and also deductibles you choose the company that is ideal for you will certainly vary. It will certainly also vary based upon your driving record and also other score factors that are particular to your existing situation. If you intend to approximate your car insurance policy prices, no fears we can help you with that also. You can then purchase the policy straight from Insurance coverage - risks. com, proceed to an insurance service provider's website or talk with an accredited insurance policy representative over the phone - vehicle insurance. You can likewise view rates by age, prices by state and prices by company. With every one of these methods to estimate and compare expenses you should have an excellent idea of what you ought to be paying. How to estimate cars and truck insurance policy before acquiring an automobile, When you remain in the hunt for a new cars and truck( whether it's a brand

auto insurance money low cost insurance

auto insurance money low cost insurance

cheap car insurance perks insurance low cost

cheap car insurance perks insurance low cost

brand-new automobile or just brand-new to you), it is important to look around for auto insurance prices at the exact same time - low cost. You don't desire to locate the perfect car only to figure out you can pay for the car settlements but not the price to insure it. You do not want to miss out on out on crucial defense for your automobile by avoiding a protection - insurers. Cars and truck insurance costs approximately $1,202 each year, according to a 2020 record by AAA - cheap car. That said, the expense

Average Us Car Insurance Costs By State For 2022 - Kelley ... Can Be Fun For Anyone

of your insurance costs is determined by several aspects, so it might be higher or reduced than average. Here's what you must understand about just how much car insurance coverage prices and what can impact your plan premiums. State as well as Area, Auto insurance is controlled at the state level, as well as prices can vary by state as well as also by postal code. In various other words, the preciselocation of your house can have a major influence on your month-to-month costs. The occurrence of vandalism, burglary and crashes is greater in metropolitan locations than in country locations. Driving Document, Tickets as well as various other infractions can spike your cars and truck insurance policy price because they're an indication that you might be a dangerous chauffeur. Crashes, mostly when you're at fault,can additionally create your premium prices to balloon. In some instances, you can see a rate rise after an accident also if you were not to blame for the accident however still sued. Vehicle Kind and Usage, The type of automobile you drive is an essential consideration for insurance companies. Cars that are statistically a lot more likely to be stolen may carry greater prices than others that are further down the list. And the more costly the automobile, the much more pricey the prospective insurance claims, which makes it more probable that you'll have a higher regular monthly premium. How you make use of the car is additionally important. You'll normally share the amount of miles you expect to drive each year and the main usage. For instance, if you have a long commute, you might be more likely to obtain right into a crash than a person that mostly drives on the weekend breaks for satisfaction. Demographics, Insurance service providers use a great deal of data to determine risk profiles, including demographics such as age, sex as well as marriage standing. Single men under 25 are the most likely to obtain in a crash, and they can expect their insurance coverage prices to reflectthat elevated level of degree. Also where it's not called for, you have to offer evidence that you're monetarily geared up to spend for problems if you create a mishap. If your cars and truck is funded, your loan provider may require you to bring a particular degree of insurance above the lawful minimum. Yet beyond that demand, the sorts of insurance coverage you pick as well as just how much will certainly be mirrored in your costs. Crash protection gives protection if you're in a crash as well as not to blame. Detailed security covers theft and also damages that occurs in other methods, such as criminal damage or all-natural disasters. If you enter an accident where the other celebration is at fault and also they either don't have insurance or their obligationsecurity is inadequate, this protection kicks in to help your plan bridge the gap . This type of insurance is not available in all states. Some insurance firms will likewise offer added insurance coverage kinds, such as rental cars and truck repayment as well as emergency roadside support. Along with the protection amounts you select, insurance firms will additionally consider your deductible. This is the quantity you'll pay out of pocket before your coverage starts when you sue. Other Elements, While not as popular in the choice, there are several other variables that an insurer may take into consideration when identifying your rate, consisting of: Line of work, Real estate scenario, Previous insurance policy coverage (especially, whether there's been had a gap in protection) Driving experience, Price cut eligibility. Sirijit Jongcharoenkulchai/ Eye, Em, Getty Images Just how much you need to spend for vehicle insurance policy varies commonly based upon a range of aspects. Geography is normally the most important variable for risk-free motorists with suitable credit, so it helps to recognize your state's averages. The national average for vehicle insurance policy costs has to do with$ 1621 per year, and also there are states with averages far from that number in both directions. Average National Prices, The overall national typical expense of cars and truck insurance will certainly vary based upon the source. That$ 1621 a year figure comes from Geek, Budget, while The Zebra places the average costs closer to $1502 annually. Whatever the situation might be, you'll more than likely find yourself paying more than $100 monthly for cars and truck insurance coverage. When computing national prices, a range of variables are consisted of. Nevertheless, numerous coverage choices are available from insurance coverage companies, as well as the ordinary number needs to show the most typical type of insurance coverage (car). In this instance, the nationwide cost numbers gauge policies that include responsibility, thorough, as well as accident insurance along with state-mandated insurance like personal injury security as well as without insurance vehicle driver coverage. Usually, the minimum insurance coverage will certainly cost concerning$ 676 annually, which is nearly$ 1000 less than the national typical annually. While these standards can be valuable for getting a suggestion of what insurance costs, your individual variables have one of the most influence on the costs prices you'll get. Ordinary Insurance Coverage Level, Typically, individuals have a tendency to go with even more coverage than the minimum that's legally required. Typically, complete protection will set you back not even $900 each year. North Carolina and also Idaho are also noteworthy for providing economical full coverage. The most expensive state for insurance is Michigan, as well as its ordinary premiums are much past the nationwide standard. For full insurance coverage in Michigan, you'll be paying over $4000 per year, though there are efforts to reduce this price. Aspects Influencing Your Costs, Exactly how much you should be paying for your premiums is largely influenced by differing personal variables in addition to your specific area. While any element can show just how much of a danger you will certainly be to guarantee as a chauffeur, the most crucial factors are generally the same throughout all insurer, though there are exceptions. Minimum state-required protection will constantly be the most cost effective, yet if you plan on offering your vehicle at a later date, extensive insurance coverage might be a personal need. Age: Age plays a large duty in how much your costs is. If you're over the age of 25 with a clean history, your premiums will greatly be the same for years. This is only true if you choose detailed and also accident insurance policy. Considered that the majority of people prepare to sell higher-end designs in the future, nonetheless, thorough and crash insurance coverage might be a requirement. Credit report: Your credit history shows just how reputable you are when it comes to paying back lendings. Some states, however, forbid firms from using credit report as an aspect for costs prices. Just how much you need to spend for vehicle insurance relies on several elements all collaborating. As a result of this, there300,000, however that may not be enough. If you have a million-dollar residence, you could lose it in a lawsuit if your insurance coverage wants. You can obtain additional coverage with a Personal Umbrella or Personal Excess Obligation policy. The better the worth of your properties, the much more you stand to shed, so you require to acquire obligation insurance policy ideal to the worth of your assets. You don't have to determine just how much to get that depends on the vehicle (s) you insure. You do require to determine whether to purchase it as well as just how huge a deductible to take. The greater the deductible, the reduced your premium will certainly be. Deductibles typically range from $250 to$ 1,000.