Vehicle insurance plans can consist of various kinds of coverage that serve varying objectives, and also you can pick to be covered by some or all of them. State law typically determines whether or not a deductible is called for.

This covers you if your lorry hits one more vehicle or things and also you require to pay for repair work. Crash deductibles are conventional however differ by insurance firm. If your vehicle is harmed by an occasion such as fire, a falling object hitting your windshield or criminal damage, you'll file a comprehensive insurance coverage insurance policy claim.

If the various other chauffeur in an accident is at fault yet they aren't guaranteed or don't have sufficient insurance coverage to spend for your property damages, this sort of protection will certainly concern the rescue. Deductibles are often required for this protection, yet not always, and also demands differ by state. While your cars and truck insurance coverage deductible can vary greatly depending upon numerous elements, consisting of just how much you desire to pay, cars and truck insurance policy deductibles usually range from $100 to $2,500.

When picking an insurance deductible, you'll require to take into consideration multiple variables, including your spending plan. Invest time computing just how much you can pay for to pay for an insurance deductible and how much you'll save money on your month-to-month costs by choosing a greater one. Ask on your own these questions when selecting a deductible amount.

vehicle insurance insurance company affordable auto insurance insurance companies

vehicle insurance insurance company affordable auto insurance insurance companies

If you get in an accident, can you manage the deductible or would certainly you battle to pay it? Taking on a high deductible may not make much sense if it represents a big portion of the automobile's value.

Not known Incorrect Statements About Car Insurance Deductible: What Is It And How Does It Work?

Note, your cars and truck's real cash money worth considers the cost of your car when you acquired it, in addition to the age as well as condition it's in at the time of the accident. Just how do I pick an insurance deductible? It is essential to choose a deductible that you fits your monetary situation. dui.

On the other hand, if you do not have sufficient cash to cover your insurance deductible in the occasion that there's protected damage to your vehicle, you may have problem obtaining your car dealt with. To pick the correct amount, believe regarding just how much you might pay out-of-pocket to have your automobile taken care of without experiencing a great deal of monetary tension in your life. cheap insurance.

You have a collision case that causes $6,000 in damage to your vehicle, which has a real money worth of $20,000. 00 insurance deductible.

cheaper suvs auto insurance cheap auto insurance

cheaper suvs auto insurance cheap auto insurance

Have inquiries regarding your existing insurance deductible or changing it? Give us a call at or come by a Direct Car Insurance coverage area near you (auto).

Allow's state you simply entered a wreck and also your car requires $4,000 in repairs, yet your insurance policy will only cover $3,000. If you're perplexed, recognizing your car insurance deductible may be the response. In this post, we'll clarify what an automobile insurance policy deductible really is, when you require to pay it, and whether you should pick a high or low one.

Rumored Buzz on What Does Deductible Mean In Car Insurance? - Car And Driver

You do not actually pay a deductible to the insurance policy company you pay it to the repair shop when they fix your automobile - auto insurance. If you have a $500 insurance deductible, you have to pay that amount prior to the insurance company pays the staying $1,500.

Your automobile insurance deductible doesn't work like your wellness insurance deductible. With wellness insurance policy, you have an insurance deductible that obtains reset every year.

low cost car cars car insurance

low cost car cars car insurance

With cars and truck insurance coverage, you pay your insurance deductible every time you file a claim. On your means to the repair store, a freak hailstorm tornado includes even more damages to your car.

There is no limit to exactly how numerous times you pay your insurance deductible in a year. Exactly How Do Vehicle Insurance Coverage Deductibles Work?

If you live in an area with regular negative weather, you may desire to select a reduced detailed insurance deductible to limit what Discover more you pay out of pocket. At the exact same time, you can maintain your accident insurance deductible higher to stabilize out your auto insurance policy costs.

The Only Guide to Zero Deductible Car Insurance

In that situation, your automobile insurance policy costs would certainly cost more to balance out the $0 vehicle insurance policy deductible. When Do You Pay An Automobile Insurance Policy Deductible? Right here are the primary circumstances in which you would certainly be liable for paying an insurance deductible: If you trigger a vehicle mishap and also your cars and truck requires repair work, you'll pay your insurance deductible on your accident coverage. money.

auto insurance affordable cars credit

auto insurance affordable cars credit

Exactly how To Pick An Automobile Insurance Policy Insurance Deductible Now that you recognize what a car insurance deductible is, it is essential to select the best insurance deductible for your scenario. You need to choose a high vehicle insurance coverage deductible if you intend to reduce your monthly expense and also if you have the capability to pay it.

If you don't have any financial savings, it's not a wise concept to have a high deductible. You could be the best vehicle driver in the globe, but you still share the road with bad vehicle drivers and also without insurance motorists. According to the Insurance Policy Details Institute, regarding 6 percent of vehicle drivers that had collision coverage filed an insurance claim in 2018.

You can always select a lower insurance deductible while you save up an emergency situation fund as well as after that elevate the deductible in the future. You need to pick a reduced car insurance coverage deductible if you don't have the capability to pay a high one, or if you desire to secure your out-of-pocket prices. A reduced deductible can be an excellent suggestion if you live in a stuffed area where you have a higher opportunity of experiencing a crash.

Some programs will reset your insurance deductible to the full amount after you make a case, as well as others will reset it to a smaller quantity. Last but not least, these programs aren't totally free. They can cost around $20 or even more annually. After five years, you would certainly have paid an added $100 or even more to your insurance policy company.

Choosing Your Deductibles To Save Money - National Bank ... Fundamentals Explained

What Happens If You Can't Pay Your Deductible? When paying out an insurance coverage claim, your insurance provider will frequently write you a look for the amount it's liable for covering. If you are incapable to pay the rest of your costs for the insurance deductible, you might have some choices. Below are some actions you can take if you can not pay for to pay your deductible: It can be worthwhile to speak to your mechanic about settlement options after an accident. cars.

car insurance dui vans cars

car insurance dui vans cars

Recognizing when to change your insurance deductible and when to look around for a brand-new vehicle insurance firm with affordable prices is the safest means to avoid high costs in the future (cheapest car). Our Referrals For Auto Insurance Policy Searching for automobile insurance coverage doesn't need to be hard. Simply make sure to get quotes from multiple suppliers, so you can compare rates.

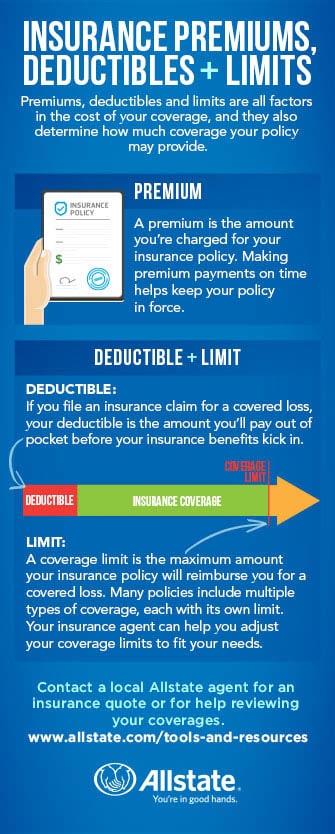

If you have actually currently experienced an insurance claim, you've most likely discovered just how your deductible jobs first hand. For those that have not, it can create confusion around just what an insurance deductible is as well as who spends for it. credit. What an insurance deductible is An insurance deductible is the quantity of cash you (the named insured on the plan) pays out of pocket for the cost of problems before the insurance provider pays.

Your insurance business will pay the staying equilibrium of $500 to the garage. Considering that you have chosen a $500 insurance deductible, you will be liable for the expenditures.

It's not component of the premium. When you pay your insurance policy costs, you aren't adding to an interest-bearing account versus future losses. While the amount of your deductible can increase or lower your premium, deductible and also costs are two various points. It's not something that the insurance provider pays. The named insured on the plan is liable for paying the deductible quantity.

The Main Principles Of How Does Your Car Insurance Deductible Work?

This indicates that even if another person was driving your vehicle and also got involved in an accident, your insurance coverage firm would certainly handle the case and also you would certainly be in charge of your plan deductible. It's not the same as a medical insurance deductible. auto insurance. Deductibles for medical insurance policies generally cover an entire one year, implying you would only compensate for your deductible (i.

However, a vehicle insurance coverage deductible uses "per event." This implies you are responsible for your complete insurance deductible quantity each time you endure a covered loss. As with all things insurance policy, it's ideal to review deductibles and just how they use in your circumstance with a local independent insurance policy agent. Your regional independent representative has the expertise and also experience to respond to frequently asked concerns about deductibles and also compute expense financial savings for you depending upon the deducible quantity you pick.

When it involves vehicle insurance, a deductible is the amount you 'd have to pay of pocket after a covered loss prior to your insurance protection starts. Automobile insurance deductibles function in a different way than medical insurance deductibles with automobile insurance coverage, not all sorts of protection need a deductible. Liability insurance does not need an insurance deductible, but comprehensive and also accident insurance coverage typically do.

When you're including that insurance coverage to your cars and truck insurance coverage, you'll generally have the possibility to make a decision where you intend to set the deductible. credit score. Typically, the higher you set your insurance deductible, the lower your regular monthly insurance coverage costs will be yet you don't intend to set it so high that you wouldn't have the ability to in fact pay that amount if needed.

What does a vehicle insurance deductible mean? A deductible is the quantity of cash you need to pay out of pocket prior to your car insurance policy will certainly cover the remainder - laws. If you backed your vehicle right into a telephone pole, your crash insurance coverage would pay for the price of the damages.

Understanding Car Insurance Deductibles - Policygenius - Truths

If the overall cost of repair work concerns $1800, your insurance will only spend for $1300 (cheap). You can discover your insurance deductible amounts is noted on your statements page. Needing to pay an insurance deductible ways you can do a kind of cost-benefit analysis before you make an insurance claim with your insurance firm.

What kind of protection requires a deductible?, which covers the prices if you damage somebody's residential or commercial property or harm somebody with your vehicle, never calls for a deductible., and where you set your deductible will have an affect on your monthly insurance policy premium.