When Do You Pay a Deductible? You'll normally pay your insurance deductible directly to the automobile repair service store after they complete the repair services.

As the car's worth comes down, the chance of a complete loss goes upmeaning it might not be worth purchasing optional protections. The Kansas Insurance policy Division suggests bring just responsibility protection on automobiles worth much less than $3,000.

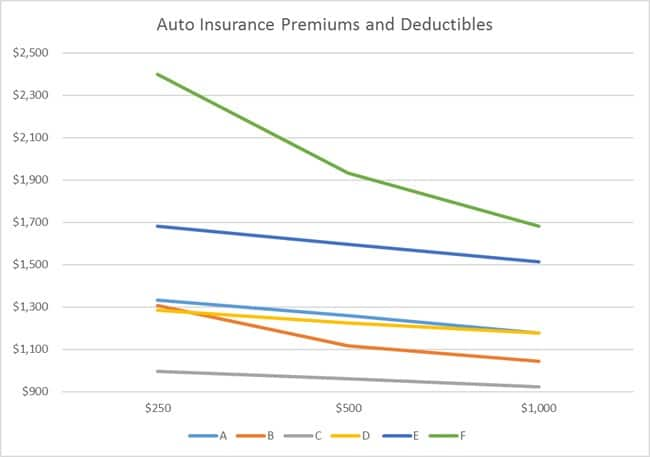

Various Other Inquiries to Ask When Choosing Deductibles While the three elements above are the most critical when picking a deductible, you'll intend to ask these questions, also. Is There a Required Minimum Deductible? It depends on your insurance provider as well as state. Several coverage deductibles begin at $250 or $500, yet some insurance companies use a $0 deductible alternative for particular insurance coverages, and also others may require higher-risk vehicle drivers to bring greater deductibles.

Can You Make Use Of Other Insurance to Cover the Costs of Injuries? In some states, you might be able to utilize health and wellness coverage to pay the costs of injuries due to cars and truck accidents rather than relying upon vehicle insurance coverage, such as medical repayments or PIP insurance policy. In this instance, you may select a higher deductible or a reduced limitation on those coverages, which would certainly save you cash.

If your cars and truck is currently at the service center, you can get a loan to pay the deductible or ask the store to hold your lorry till you can discover some additional money. What Is the Highest Insurance Deductible for Auto Insurance Coverage? The highest insurance deductible offered to you depends on your state and your insurance provider, yet Mc, Bride-to-be stated a typical high deductible is around $1,000.

What's A Car Insurance Deductible And How Does It Work? Can Be Fun For Everyone

For specialized lorries or collectibles, they can reach $5,000 to $10,000. What Is the Typical Deductible for Car Insurance Coverage? No nationwide standard throughout states as well as insurance providers has been released, yet Progressive claims $500 is the most usual insurance deductible selected by its insurance holders.

Keep in mind, your vehicle's real money value takes into consideration the rate of your automobile when you acquired it, in addition to the age and also condition it's in at the time of the accident. suvs. Just how do I select an insurance deductible? It is very important to select an insurance deductible that you fits your financial circumstance.

On the various other hand, if you don't have adequate cash to cover your insurance deductible in case there's protected damages to your lorry, you might have difficulty obtaining your auto dealt with. To pick the correct amount, think of just how much you can pay out-of-pocket to have your automobile repaired without experiencing a Hop over to this website great deal of financial stress in your life.

00 deductible. affordable auto insurance. This means you are responsible for paying the first $500.

Have concerns concerning your current deductible or adjusting it? Offer us a phone call at or visit a Direct Vehicle Insurance policy place near you - cheapest car insurance.

Some Ideas on How Does Car Insurance Deductible Work? - Experian You Should Know

Let's state you simply entered an accident and also your vehicle needs $4,000 in fixings, but your insurance coverage will only cover $3,000 (dui). If you're confused, recognizing your car insurance policy deductible may be the response. In this post, we'll explain what a cars and truck insurance deductible really is, when you need to pay it, and also whether you need to pick a high or reduced one.

You don't in fact pay an insurance deductible to the insurance company you pay it to the repair shop when they fix your automobile. Depending on your state, you might have an insurance deductible for other types of coverage, as well.

Insurance providers will certainly not be in charge of expenditures that do not surpass your insurance deductible. Your car insurance coverage deductible doesn't work like your health and wellness insurance policy deductible. With wellness insurance coverage, you have a deductible that obtains reset annually. As you make use of health solutions, the cash you invest out of your very own pocket will accumulate. insured car.

When the new year rolls about, everything starts over. With automobile insurance, you pay your insurance deductible every time you submit a claim. Allow's state you got involved in a mishap and submitted an accident insurance claim. On your method to the repair work store, a freak hail storm adds more damages to your automobile.

There is no restriction to exactly how several times you pay your insurance deductible in a year. If you submit 5 various collision insurance claims in one year, you'll pay your insurance deductible five times.

The Main Principles Of What Is A Car Insurance Deductible? - Insurance Navy

If you live in an area with frequent poor weather, you may desire to choose a lower comprehensive deductible to restrict what you pay out of pocket. At the very same time, you can maintain your collision deductible higher to balance out your automobile insurance coverage costs.

In that case, your automobile insurance policy costs would certainly set you back more to counter the $0 auto insurance policy deductible. When Do You Pay An Automobile Insurance Policy Deductible? Here are the major circumstances in which you 'd be in charge of paying an insurance deductible: If you trigger a car mishap as well as your auto needs fixings, you'll pay your deductible on your accident coverage - low cost auto.

Just how To Choose A Vehicle Insurance Insurance Deductible Currently that you understand what a car insurance deductible is, it is important to choose the ideal deductible for your scenario. You should select a high auto insurance deductible if you wish to reduce your regular monthly costs and also if you have the ability to pay it (perks).

If you don't have any type of financial savings, it's not a clever suggestion to have a high insurance deductible. You might be the most effective driver in the globe, yet you still share the roadway with negative chauffeurs and uninsured vehicle drivers - business insurance. According to the Insurance Coverage Details Institute, regarding 6 percent of motorists who had accident coverage submitted a case in 2018.

You can constantly pick a reduced deductible while you save up an emergency fund and after that raise the deductible later on. You ought to select a reduced car insurance coverage deductible if you do not have the capacity to pay a high one, or if you intend to safeguard your out-of-pocket costs. A reduced insurance deductible could be a good suggestion if you live in a congested area where you have a higher opportunity of experiencing a mishap (perks).

9 Easy Facts About What Are Auto Insurance Deductibles & How Do They Work? Described

Likewise, some programs will reset your deductible fully amount after you make an insurance claim, and others will reset it to a smaller sized amount. Finally, these programs aren't cost-free (cheapest). They can cost around $20 or even more each year. After five years, you would have paid an extra $100 or more to your insurance policy firm.

What Takes place If You Can't Pay Your Deductible? When paying out an insurance claim, your insurer will typically write you a look for the quantity it is accountable for covering. If you are unable to pay the remainder of your prices for the insurance deductible, you might have some alternatives. Below are some actions you can take if you can't afford to pay your insurance deductible: It might be worthwhile to speak to your mechanic about settlement alternatives after an accident.

Knowing when to readjust your insurance deductible and also when to search for a brand-new vehicle insurance coverage business with budget friendly prices is the best way to stay clear of high expenses in the future. Our Suggestions For Auto Insurance Coverage Searching for car insurance does not need to be hard. Just ensure to obtain quotes from several service providers, so you can compare rates.

What is an insurance deductible? An insurance deductible is the amount you pay out of pocket toward fixings for your car due to a protected loss - cheapest car insurance. If you have a $500 insurance deductible and you're in an accident that results in $3,000 of repairs to your vehicle, you pay only $500 towards repair work.

In most markets, when you're not to blame for a mishap, we can forgo the insurance deductible if we can recognize the other event, that they're at mistake, and their insurance coverage service provider verifies they have valid liability insurance coverage for the accident. This examination can take time, so the deductible may apply at the beginning of the case and be repaid later.

The 15-Second Trick For What Does Deductible Mean In Car Insurance? - Car And Driver

Your deductible just uses when your insurer pays for your automobile fixings. car insured. There is no deductible if the other celebration's insurance is dealing with the repair services. The deductible only applies to your own vehicle repairs. There is no insurance deductible for the other celebration's lorry fixings under your policy. Your cases service representative will send you a reimbursement check for your deductible.

Choosing an auto insurance deductible can result in severe economic ramifications if not done. Deductibles are without a doubt a resource of confusion and frustration for lots of people, specifically thinking about the selection of choices offered - insurance affordable. It's not very easy to determine whether to choose a high costs or high deductible with cars and truck insurance policy.

You back up your auto as well as collide with a fire hydrant that results in $3,000 worth of repair work expenses. To ensure your vehicle insurance policy covers the repair services, you will certainly need to file a collision claim. If you select a $500 insurance deductible, this is the sum you'll need to pay, and also your insurance provider will certainly cover the remainder of $2,500.

If you get associated with an accident and sue, the insurance policy carrier will subtract the deductible from the covered claim. If the damages is significant, you will certainly pay the insurance deductible, and the insurance firm will certainly cover the staying quantity - business insurance. However, if the damages is minor, several vehicle drivers choose to pay of pocket instead of paying a deductible.

As an example, you can actually conserve some money when choosing a $1000 insurance deductible over a $500 one. This may or might not make much feeling depending on individual conditions and your insurance expenses. Additionally, if you reside in a no-fault state, your insurance coverage service provider will need to cover the cost of medical costs irrespective of that caused the crash.

The Single Strategy To Use For What Is A Deductible In Auto Insurance? - Car Registration

If you are submitting a damage case under crash insurance policy, you will certainly need to pay a deductible. Comprehensive insurance policy completes the gaps that the crash coverage leaves behind. Problems taking place to your automobile outside of accident insurance coverage are included in detailed insurance coverage - money. In addition, weather-related problems, burglary, as well as criminal damage are likewise covered.

Raising your insurance deductible from $200 to $500 can decrease the extensive and crash premium price by approximately 30%. On the other hand, if you increase the insurance deductible to $1000, it could lower the costs to 40% and more. insure. Given that the insurance deductible amount is vice versa proportional to the quantity of the costs you have to pay, the higher your insurance deductible, the reduced your premium prices will be.

Some choose to go even greater than that to pay reduced costs. This can make the expenditures much less foreseeable as you do not understand when you will certainly finish up with greater repair service expenses. On the various other hand, others want to have more monetary protection, so they choose a lower vehicle insurance coverage deductible and also a higher costs.